2020 Statistics – Mergers & Acquisitions in France

1. Introduction

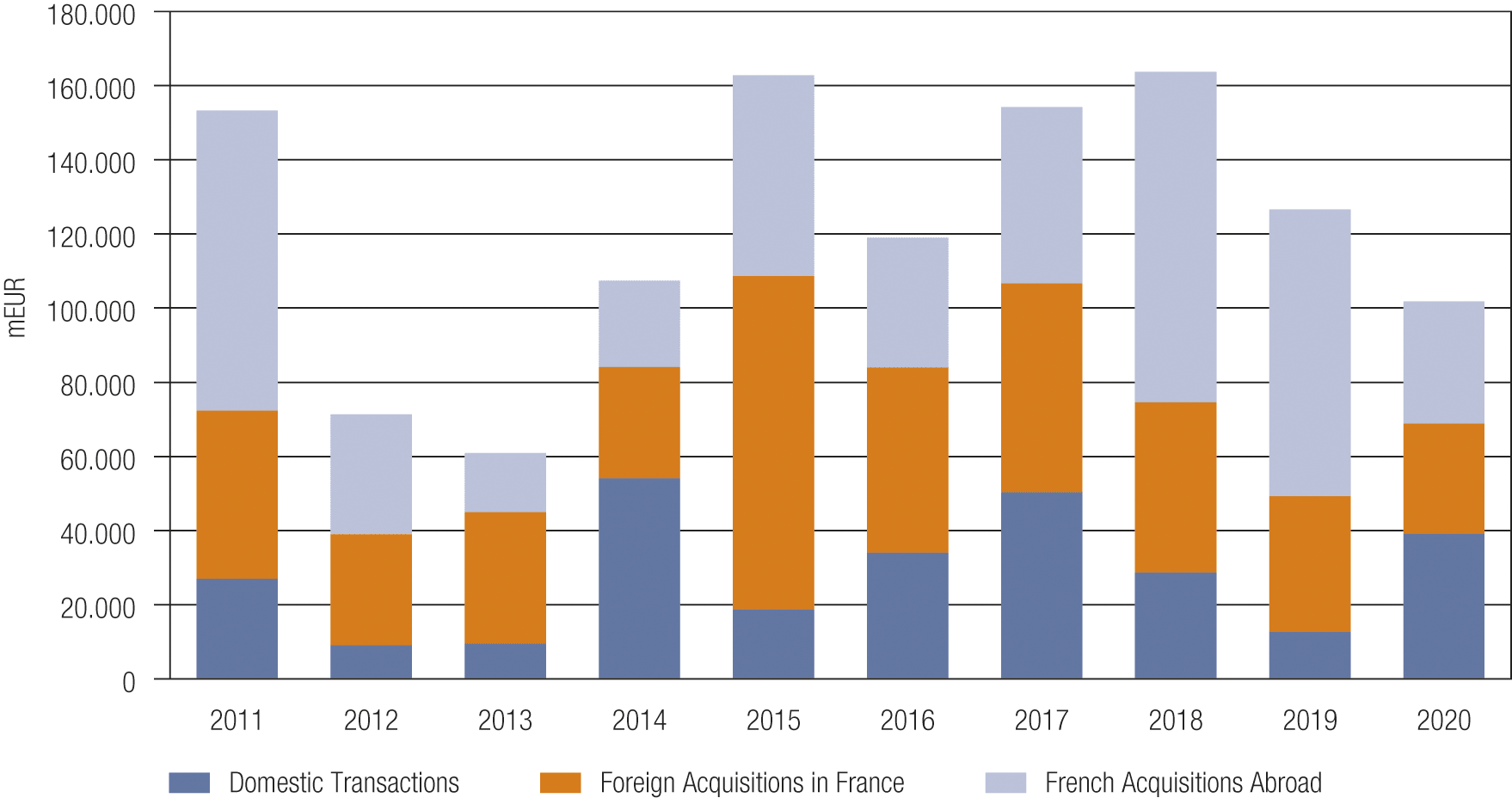

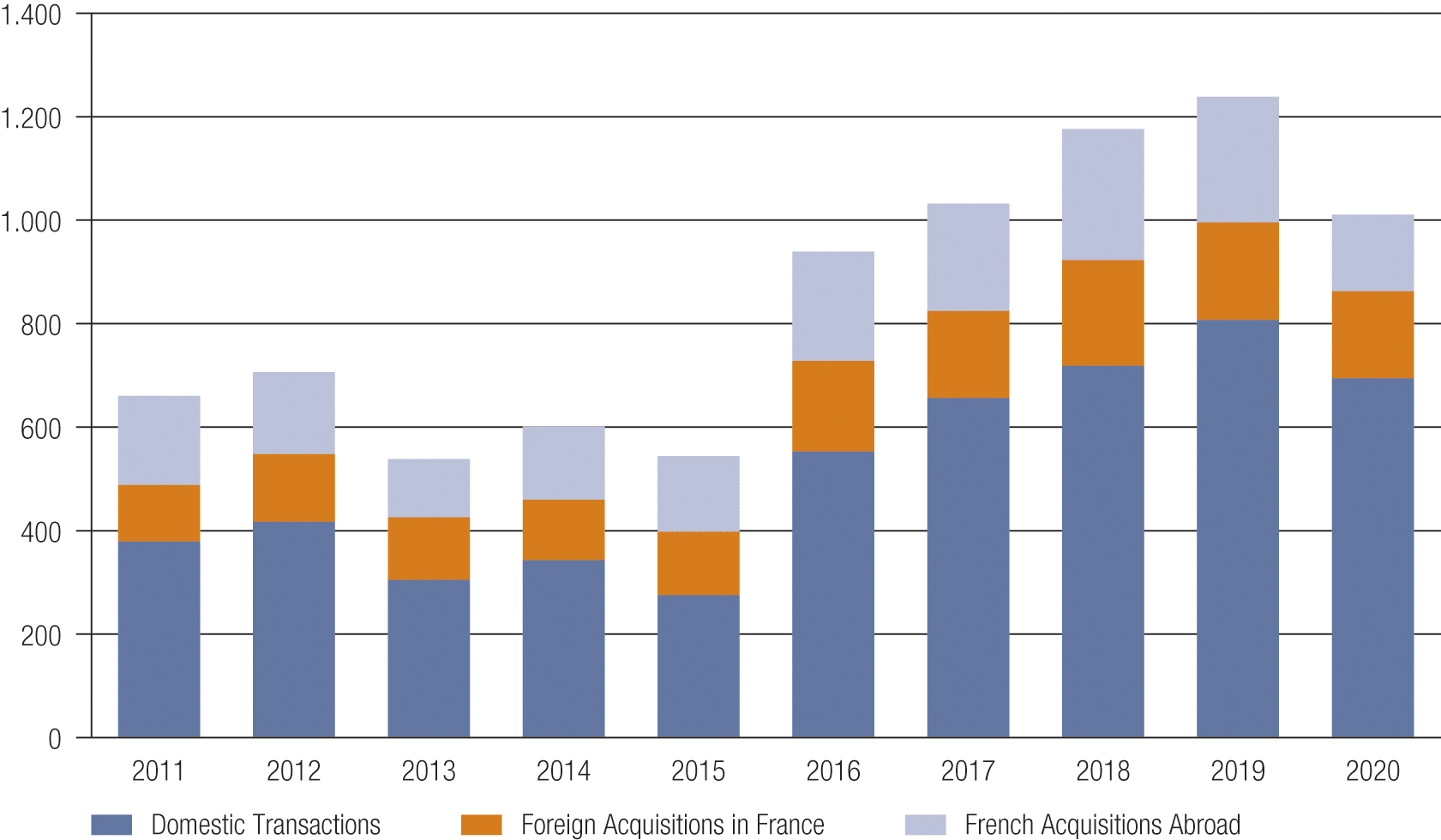

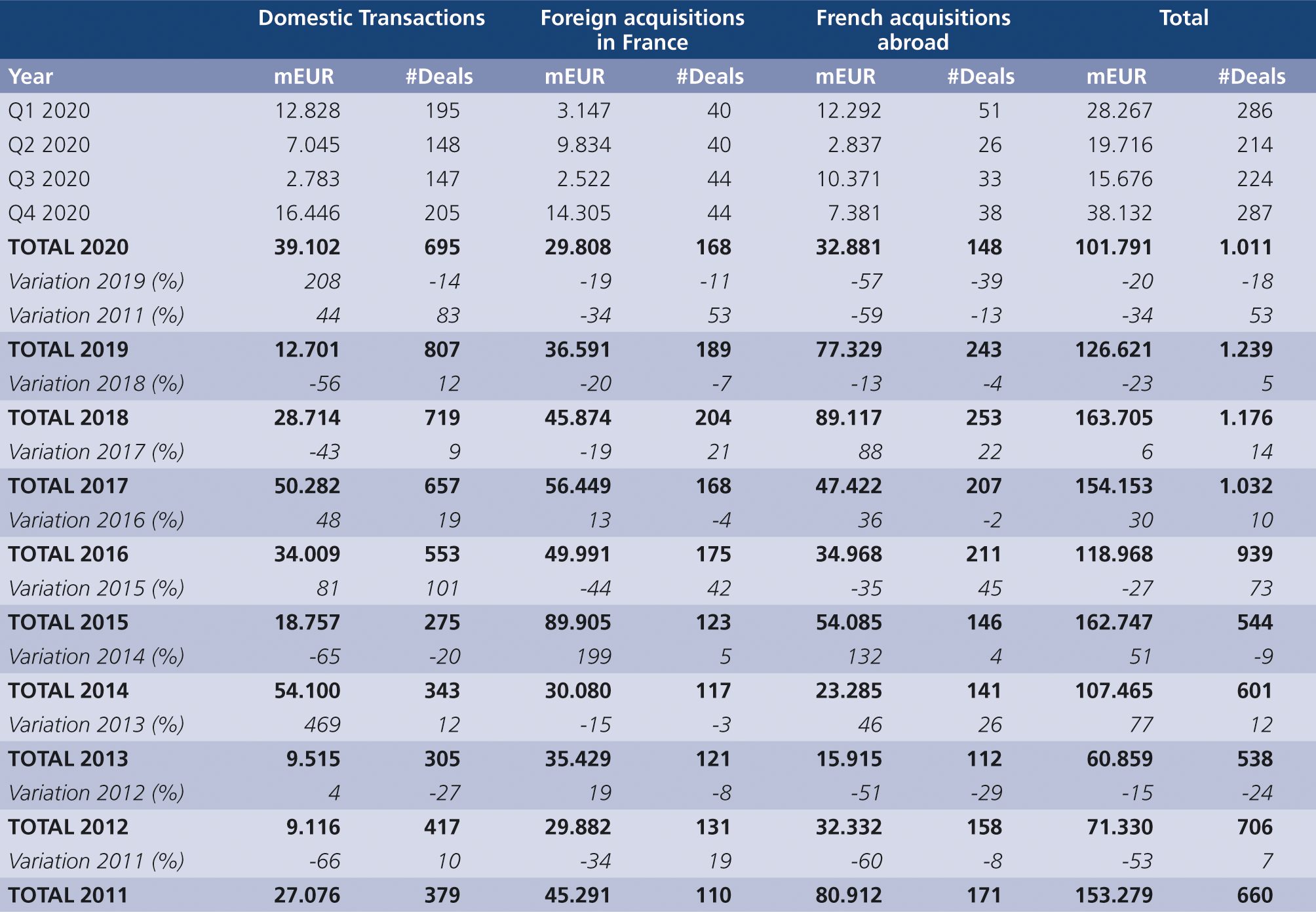

• 101.8 billion EUR for 1,011 operations finalised in 2020

• an amount down 20% compared to 2019

• the amount of domestic acquisitions up 208% compared to 2019

In 2020, Fusions & Acquisitions Magazine was able to identify 1,011 M&A and private equity transactions involving at least one French company, with a total volume of EUR 101.8 billion, a 20% decrease compared to 2019 (EUR 126.6 billion). The number of transactions decreased by 18%.

Last year, 32 deals worth EUR 1 billion or more were completed, compared to 35 deals in 2019 and 46 deals in 2018.

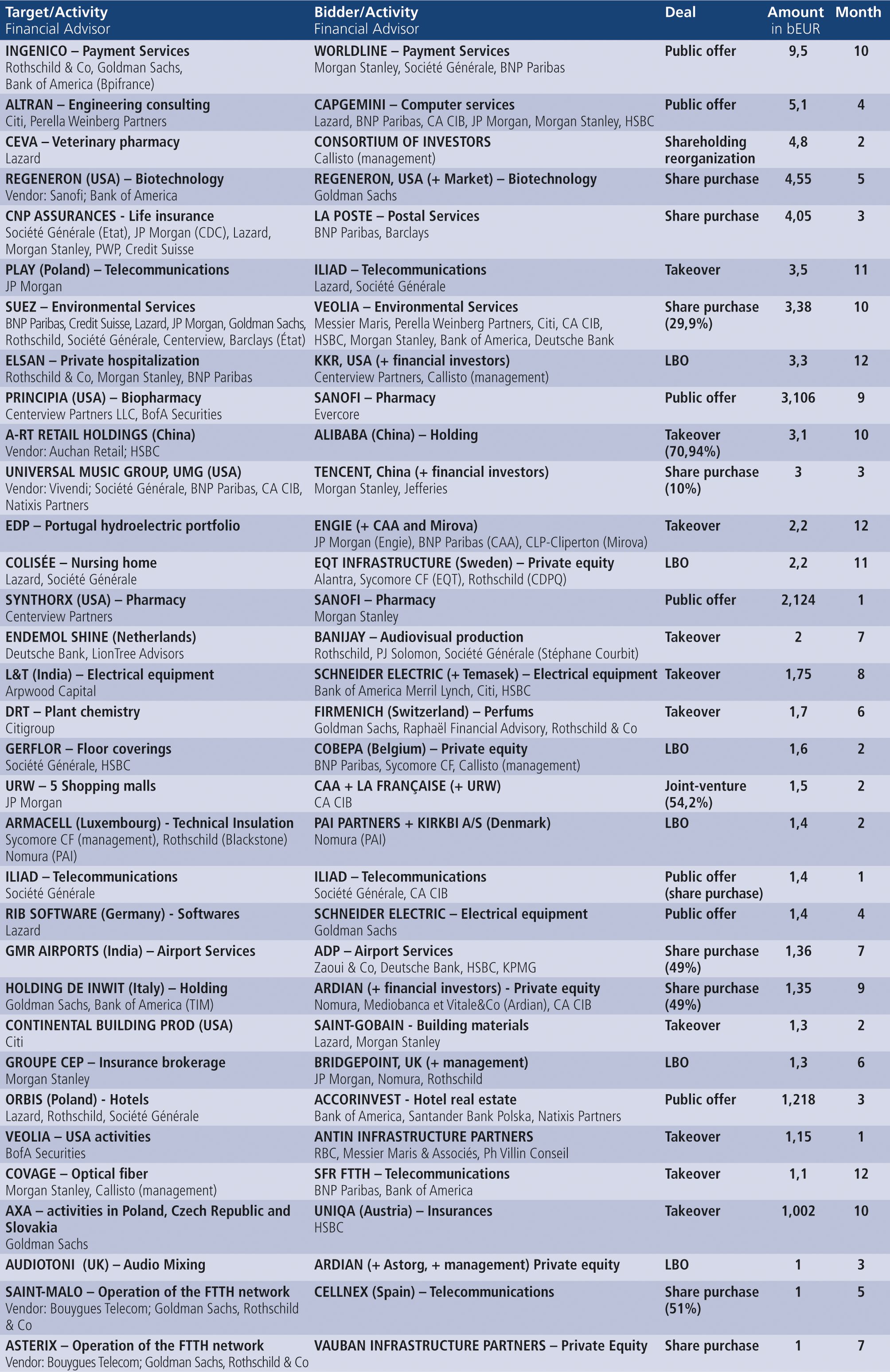

By far the largest deal of the year by value was Worldline’s acquisition of Ingenico for EUR 9.5 billion (including debt), creating a new global leader in payment services.

The boards involved are – on the Worldline side – Morgan Stanley, Société Générale and BNP Paribas. Ingenico was advised by Rothschild & Co and Goldman Sachs. Bank of America acted as legal advisor to Bpifrance, an Ingenico shareholder.

This deal makes Worldline the world’s fourth largest payment services provider, with more than 20,000 employees and a presence in more than 50 countries. The new company provides payment services to nearly one million merchants and 1,200 banks and financial institutions.

Capgemini’s friendly takeover bid for Altran of EUR 5.1 billion (including debt) came in second. The merger will create a group with revenues of EUR 17 billion and more than 250,000 employees. It will enable Capgemini to accelerate its development in large technology companies and the Internet. Thanks to its centres of excellence, particularly in India and Eastern Europe, the new group has critical mass in software engineering.

Citi and Perella Weinberg Partners advised Altran on the deal, while Lazard, BNP Paribas, CA CIB, JP Morgan, Morgan Stanley and HSBC acted on Capgemini’s side.

Third place on the podium in terms of value comes from the nearly EUR 5 billion roundtable recomposition of Ceva Santé Animale, advised by Lazard.

The 4 new investors are: Téthys Invest, the investment holding company of the Bettencourt-Meyers family; Canada’s PSP Investments; Japan’s Mitsui & Co and Germany’s Klocke Group, whose animal health business IDT was acquired by Ceva in 2019. They join French shareholders, the “Amis de Ceva”, who are investing again in this 5th financing round, namely Sofiproteol and Merieux Equity Partners.

Also worth mentioning is the sale by Sanofi – advised by Bank of America – of its stake in the US biotech company Regeneron, accompanied by Goldman Sachs (a deal worth EUR 4.55 billion).

Finally, let’s mention the deal CNP Assurances / CDC / La Poste which allows Banque Postale to become the majority shareholder of CNP Assurances, for EUR 4 billion. At the same time, Caisse des Dépôts acquired an additional stake in La Poste’s capital from the French State for nearly EUR 1 billion.

In 2020, among the biggest deals of the year, only two deals are worth more than EUR 5 billion, compared to 4 deals in 2019.

1. Domestic Transactions: +208%.

After an increase of 48% in 2017, the amount of domestic acquisitions decreased by 43% in 2018 and then by 56% in 2019. In 2020, the amount of domestic acquisitions reached EUR 39.1 billion, an increase of 208% compared to 2019.

In terms of the number of deals, there was a 14% decrease compared to 2019. In 2020, 695 deals were completed, compared to 807 in 2019 and 719 in 2018.

A total of 12 domestic deals worth EUR 500 million or more were completed in 2020, including 4 private equity operations.

The largest domestic deals are Worldline / Ingenico, Capgemini / Altran, Ceva Santé Animale, CNP Assurances / CDC / La Poste and Veolia Environnement / Suez (29.9% du capital).

Source: Fusions & Acquisitions Magazine

2. French acquisitions abroad: - 57%.

After a colossal increase of 88% en 2018, this sector recorded a 13% drop in value in 2019. In 2020, the total value was EUR 39.9 billion, a decrease of 57% compared to 2019.

In terms of the number of deals, 148 French acquisitions abroad were completed in 2020, a decrease of 39% compared to 2019.

There were 19 French acquisitions abroad worth more than EUR 500 million in 2020, including 6 private equity transactions. Among them, no transaction worth more than EUR 5 billion.

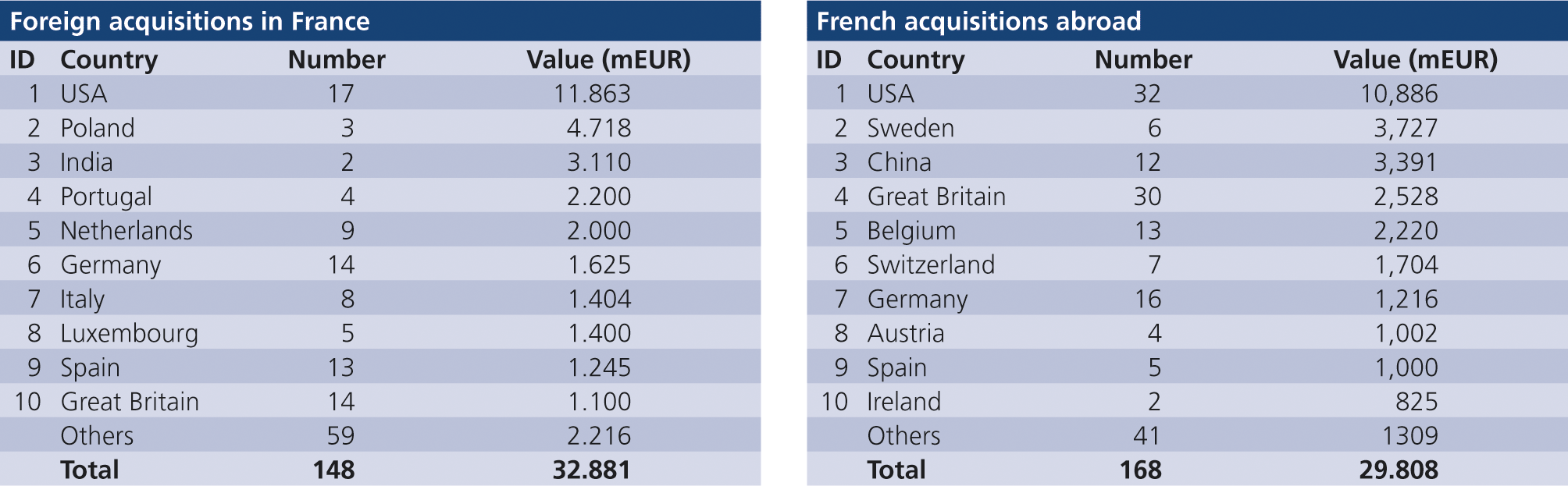

The preferred destinations for the French in 2019 were the United States, Poland, India, Portugal, the Netherlands and Germany.

Source: Fusions & Acquisitions Magazine

3. Foreign acquisitions in France: - 19%.

In 2020, the foreign acquisitions sector in France recorded a 19% decline in value, following a 20% decline in 2019.

Last year, 168 transactions were carried out for a total of EUR 29.8 billion, compared to 189 transactions and EUR 36.6 billion in 2019.

In 2020, a total of 13 transactions worth more than EUR 500 million were identified in this sector. Parmi and 7 private equity transactions.

The main countries of investment in France in 2020 were the United States, Sweden, China, the United Kingdom and Belgium.

Source: Fusions & Acquisitions Magazine

4. Private Equity

In our statistics, transactions in this area are part of the 3 main areas mentioned above.

For transactions above EUR 500 million, 18 transactions were recorded in 2020, compared to 17 transactions in 2019, 19 transactions in 2018 and 15 transactions in 2017.

Source: Fusions & Acquisitions Magazine

5. The most dynamic sectors

The classification by sector of activity is based on NAF codes of the target companies.

In 2020, the most dynamic sector was “Financial services, excluding insurance and pension funds” with 54 transactions with a total value of more than EUR 16 billion. This sector was in third place in 2019.

– Second place went to the “Programming, consulting and other IT activities” sector (No. 4 in 2019), with 143 deals worth almost EUR 13 billion (by far the No. 1 sector in terms of number of deals).

Third place goes to the “Scientific research and development” sector (not among the main sectors in 2019 in terms of value) with EUR 10.4 billion for 37 deals in 2020, followed by the “Telecommunications” sector with 18 operations and EUR 7.6 billion (No. 6 in 2019).

Source: Fusions & Acquisitions Magazine

Source: Fusions & Acquisitions Magazine

Source: Fusions & Acquisitions Magazine

Source: Fusions & Acquisitions Magazine