COVID-19 impact on Mergers & Acquisitions

Situation: COVID-19 – A significant disruption of the world economy

COVID-19, also known as the Coronavirus has hit the world first end of last year in Wuhan, China and has become a worldwide pandemic by now with more than 330’000 people infected (14’500 deaths) in 196 countries according to the World Health Organization (data as of 23rd of March 2020).

Not only is the Coronavirus a major health problem, but it has also developed into a major disruption of the world economy as it is largely impacting the demand side as well as supply side across all industries on a global scale combined with a high uncertainty on the financing side.

As an effect, stock markets around the world have been sliding over the last 30 days such as US Dow Jones -36%, S&P 500 -33%; German DAX -36%, French CAC 40 -35% with some notching their worst days of trading ever (data as of 23rd of March 2020).

Company valuations of large industry companies have partly halved over the last 30 days, such as Airbus (-58%), MTU Aero Engines (-57%), Continental (-48%), Daimler (-45%), VW (-44%), BMW (-38%) (data as of 23rd of March 2020), with first companies fearing (hostile) takeovers. So, the question that is raised is: What is the impact of Covid-19 on Mergers and Acquisitions?

Impact on M&A: COVID-19 – Likely leading to (partial) takeover of companies, engagement of OEMs at suppliers, Carve-out related deals and government funding at certain conditions

Hypothesis 1: Takeover of companies / assets by “cash rich” investors will continue

There is currently an abundance of cash ready to be invested by Private Equity and Sovereign Wealth Funds. “Dry powder” has increased steadily over the past years, reaching USD 2.5 trillion in 2019 (roughly a third of which is in Buyout Funds).

COVID-19 related low company valuations (and lower multiples / chances for higher IRR) of the large industry companies (see figures above) could attract “cash rich” investors to (partial) takeovers, e.g. build-up of relevant minority stakes and takeover bids for listed companies with deteriorating stock prices and potential P2P afterwards.

As an example, Daimler is already fearing additional influence from the Chinese Geely Auto Group, that is already owning 50% of Smart as part of the Mercedes portfolio according to a report by the German Manager Magazine.

Hypothesis 2: Involvement of OEMs at suppliers, accelerated horizontal / vertical integration will become more common

COVID-19 related production slow-down up to shut-down and related supply chain impact could force OEMs to support suppliers in order to ensure stability of the entire industrial system, either via cash bridges or M&A, which for some industries would be equal to a re-insourcing of certain value chain activities.

This would further accelerate ongoing consolidation by strategic players to broaden value chain (horizontal / vertical integration) and create synergies by taking advantage of other’s party (financial) weakness.

As an example, in industries, where 2nd /3rd source is more a standard than an exception (e.g., automotive), OEM may tend if needed to support suppliers via cash bridges to support ongoing production. In industries, where due to the production rates, in many cases single sources are the standard (e.g., Aerospace & Defence), OEM may if needed support for a given time suppliers through taking over equity shares and through that backward re-integrate across the value chain.

Hypothesis 3: Carve-out related deals will increase

COVID-19 related financial pressure could lead to a need to divest certain assets (possibly further reinforced by activist investors).

This would further accelerate focus on core competencies and lead to increased number of carve-out related deals.

As an example, Japanese telecommunication and media giant SoftBank Group will sell up to $41 billion of assets across its global empire to slash debt and boost cash reserves according to a company announcement from Monday, 23rd of March.

Hypothesis 4: Government funding and involvement at certain conditions (e.g. job securities) will impact the M&A market

A COVID-19 related availability of exceptional schemes from public authorities and governments could lead to government funding and involvement at certain conditions, such as preserving / limiting the impact on employment.

As an example, state aid is already requested by a majority of airlines such as Air France, Alitalia, EasyJet, TUI, American, Delta, United and Latam, with Lufthansa and IAG under consideration according to company announcements as of Monday, 23rd or March.

Government funding will likely restrain takeovers of German companies by foreign investors.

Government support may also limit elements of restructuring e.g. making staff redundant if financial support has been received to pay wages.

However, COVID-19 related disruption of the world economy creates a high uncertainty – timing and cash/cost impact are unforeseeable as of today. Therefore, acquiring companies will become a risky endeavor and the timing of when we will see the hypothesis outlined above differs.

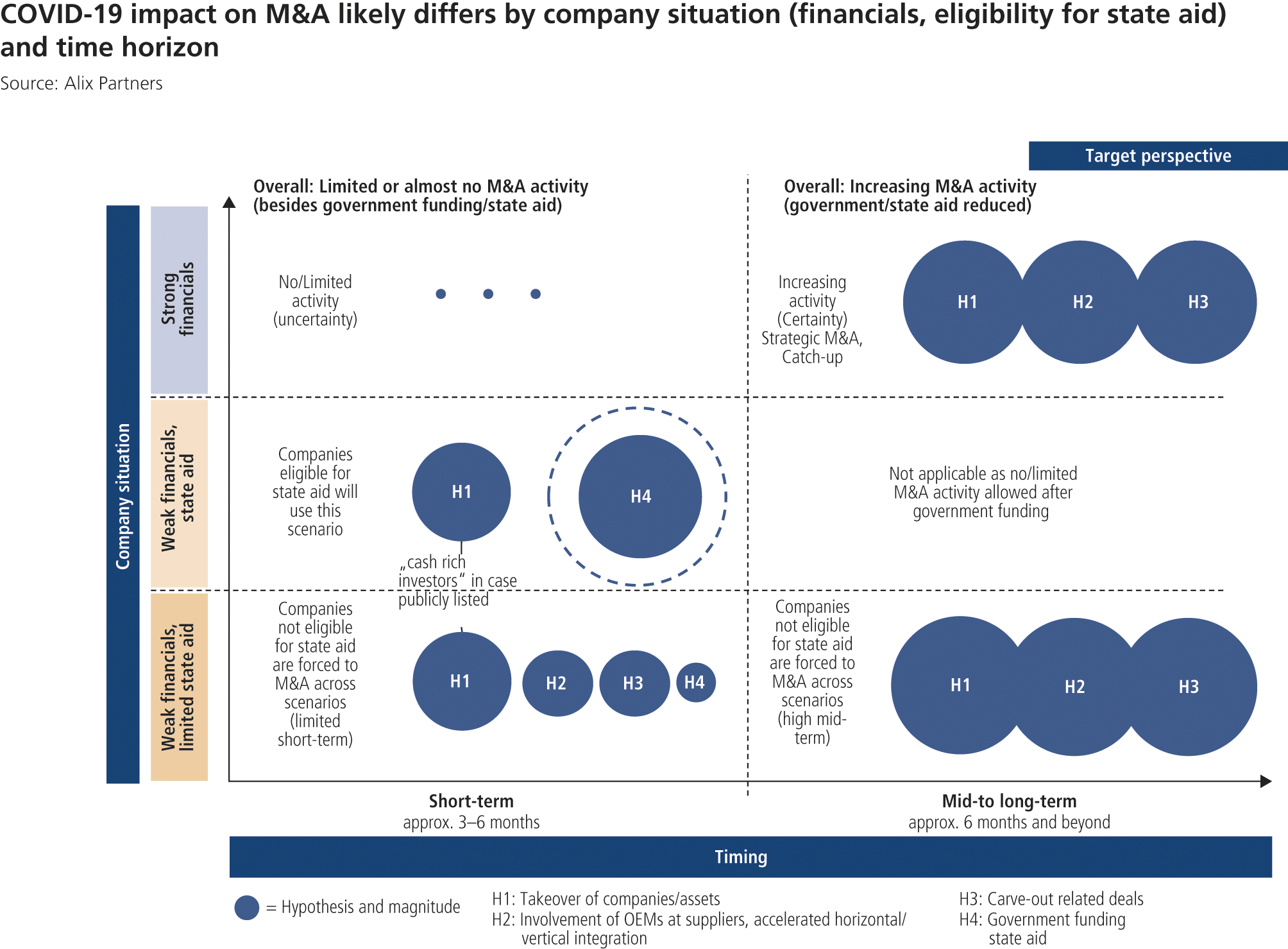

Short-term (approx. next 3-6 months): Limited or almost no M&A activity – Exception: Buildup of relevant minority stakes and takeover bids for listed companies with deteriorating stock prices and companies forced to sale out of insolvency.

Time needed to understand impact and formulate related strategy – limited or almost no M&A activity for certain periods to be expected; price finding is expected to be very difficult.

While central bank interest rates have been lowered worldwide, the willingness of banks and alternative debt providers to offer attractive debt packaged in the current uncertain times is a big question mark.

Ongoing M&A transactions will likely be stopped. Signed transactions may be affected by the acquired drawing on the MAC (major adverse change) clause (these however being only used in 15% of European transactions, compared to 90% of transactions in the USA)

Short-term (approx. next 3-6 months), we expect to see the following impacts of COVID-19 on M&A activities:

Companies in a strong financial situation will not undersell – hence, value resulting from business plan and not current multiples as price indicator limiting fire sales. Limited transactions.

Companies in weak financial situation eligible for state aid will make use of this instrument first (hypothesis 4) before considering any other M&A activities.

Companies in weak financial situation not eligible for state aid (or only to limited extend), will be forced to M&A activities, i.e. sale out of or shortly prior to insolvency (leading to hypothesis 1, 2, 3). First short-term “fire-sales” are already on the horizon. Leading German politicians have already pointed out that actions should be taken to prevent foreign investors to acquire German companies affected by the Corona crisis which could limit takeover of companies / assets by “cash rich” investors (hypothesis 1).

Companies in weak financial situation that are publicly listed will attract “cash rich” investors for buildup of relevant minority stakes up to takeover bids for listed companies with deteriorating stock prices and potential P2P afterwards (hypothesis 1). For example, Heinz Hermann Thiele (large shareholder of Knorr Bremse and Vossloh) increased his stake in Lufthansa to over 10% in light of the recent share price drop.

M&A activity overall rather asset based (cherry picking, distressed M&A) or funding related.

Mid-term to long-term (approx. 6 months and beyond): Increasing M&A activities for companies in both, good as well weak financial situation for strategic repositioning and catch-up on deals not executed.

Impact of COVID-19 becomes clear, volatility and uncertainty in the financial markets decreases with price finding expected to be eased compared to today’s situation (clarity on “winners and losers” of COVID-19).

Willingness of banks and alternative debt providers to offer debt at attractive interest rate will increase once uncertainty decreases.

Mid-term (approx. 6 months and beyond), we expect to see the following impacts of COVID-19 on M&A activities:

Companies in a strong financial situation will sell as price findings ease compared to today’s situation. Companies will use M&A to strategically reposition their firms and address key strategic trends digitalization, Industry 4.0 und e-mobility. They furthermore need to catch-up on strategic M&A deals not executed in times of uncertainty (either hypothesis 1, 2, 3).

Companies in weak financial situation that receive or received state aid will not be on the market for M&A activities.

Companies in (still) weak financial situation not eligible for state aid (or only to limited extend), will be further forced to M&A activities, i.e. sale out of insolvency (leading to hypothesis 1, 2, 3). Effect will be more severe than short-term as certainty exists for companies in strong financial situation (able to execute takeovers).

M&A activity overall adopts to the “new normal”.

Overall summary

We expect to see limited M&A activity in the short-term (approx. 3-6 months), but an increasing number of M&A activities mid-to-long-term (approx. 6 months and beyond) as a result of the COVID-19 disruption of the world economy.

Short-term focus of M&A activities will be on listed companies offering attractive valuations/deal structures as well as on distressed M&A as a result of a forced “survival of the (financially) healthiest”.

Mid-term focus of M&A activities will be on strategic repositioning, catch-up of deals not executed due to uncertainty, as well as a continued (and likely increased) number of distressed M&A activities.