Austria’s M&A Market in 2020: Suffering from a Severe Case of Covid-19

1. Introduction

[1. This article represents a translated and slightly revised version of Lang, N./Lattacher, W./Merey, T. (2021)]

The Austrian M&A market experienced a challenging year in 2020, registering a considerable decline in transaction numbers. In total, only 163 majority takeovers were announced. This corresponds to a 25% downturn compared to 2019 (217 deals) and a significant drop of 33% compared to the average number of transactions over the previous five years (2015–2019 average: 243 deals per year). A more extended investigation period reveals that the Austrian M&A market is even below the transaction level it experienced during the last major financial and economic crisis (2009: 188 transactions). The decline in activity can clearly be attributed to the phase beginning with the Covid-19 outbreak. While deal numbers were relatively stable in the first quarter (-4%), activity plummeted in the second (-37%). The following quarters were also characterized by significant yet decreasing losses compared to 2019 (Q3: 30%; Q4: -26%).

Based on this temporal distribution of losses, one may see the coronavirus pandemic as the primary cause of the substantial and prolonged downturn. Like many other countries, Austria reacted with a series of lockdowns[2. Lockdowns in Austria: March 16 to April 14, followed by gradual legal relaxation; November 17 to December 6, and December 26 to February 7, 2021. Österreichs M&AMarkt im Jahr 2020: Durchaus schwerer Coronaverlauf, M&A-Review, 32. Jahrgang, 1-2, pp. 12-18.] that affected vast areas of the economy. The resulting economic slowdown ranged between 7.3%[3. According to the Institute for Advanced Studies (IHS).] and 7.5%[4. According to the Austrian Institute of Economic Research (WIFO).] in Austria and was therefore in line with the EU average (7.4%)[5. According to the Economic Outlook of the European Commission.]. The Vienna Stock Exchange was hit even harder, recording a year-on-year decline of 12.8%. Thus, in contrast to other leading indices (such as the DAX and Dow Jones), which recovered from the coronavirus-related setbacks in the course of the year, the ATX registered a significant loss.[6. The DAX closed with a year-on-year increase of around 3.5%; even stronger growth was recorded by the Dow Jones, which saw an increase an increase of 6%.]

The problematic environment had important implications for individual decision-making. Indeed, many companies had to adapt quickly to changes in regulations and stakeholder behavior (e.g., of consumers and suppliers), limiting the scope for M&A. Moreover, the uncertainty about the pandemic’s further development and its impact on sectors and company valuations may also have reduced M&A activity. In our Covid-19 analysis (see AC MAR 9/2020),[7. AC MAR stands for: Austria Column in the (German) M&A-Review (followed by the issue and the year of publication).] we identified cases of suspended deals and closed adjustment agreements. An example is OMV, which obtained a contract adjustment for its majority takeover of Borealis. While difficult economic conditions usually induce distressed M&A, the extensive government aid packages presumably unfolded a delaying effect. Consequently, until the end of 2020, we did not see a significant increase in distressed M&A.

In addition to the pandemic, other factors that had already been negatively affecting the Austrian M&A market for some time still persisted in 2020. These include trade conflicts, trouble spots, and the Brexit (see, e.g., AC MAR 1-2/2020). The effect of these factors is reflected in the slight downward trend already visible prior to the pandemic outbreak.

2. The Austrian M&A market in 2020

As outlined above, the Austrian M&A market experienced a significant decline in activity in 2020. The number of announced majority takeovers fell from 217 to 163, a 25% decrease compared to 2019.[8. In the course of an editorial evaluation process to further improve our Austria Column, we have made changes to the data collection, definition of relevant deals, and data preparation. From now on, we will use Refinitiv (formerly Thomson Reuters) as a data source and focus on transactions that result in the acquisition of a majority stake in the target. Deals are considered at the time of their announcement. This allows us to track developments very close to the action, which is particularly advantageous in volatile times. Furthermore, the changes in data collection, definition, and preparation enable a better comparison of the development in Austria with the global situation as presented in the BCG Global M&A Report.]

2.1 Top deals

In 2020, three transactions with a deal value of more than EUR 1 billion were announced. The largest was OMV’s majority takeover of the chemicals group Borealis. OMV increased its stake from 36% to 75% at the cost of EUR 4.1 billion. With this acquisition, OMV intends to become more involved in the chemical sector. Moreover, it expects a synergy potential of more than EUR 700 million by 2025 (for details on the deal, see AC MAR 9/2020). Another billion-euro deal took place in the telecommunications sector: CK Hutchison sold passive telecommunications infrastructure to the Spanish mobile phone tower operator Cellnex. The transaction concerns infrastructure in six European countries, with the Austrian infrastructure valued at EUR 1.1 billion. A third top deal can be found in the financial sector, where the insurance group Uniqa acquired AXA’s subsidiaries in Poland, the Czech Republic, and Slovakia for EUR 1 billion. The transaction made Uniqa the fifth largest insurance group in Central and Eastern Europe (see also AC MAR 9/2020).

2.2 M&A activity by industry

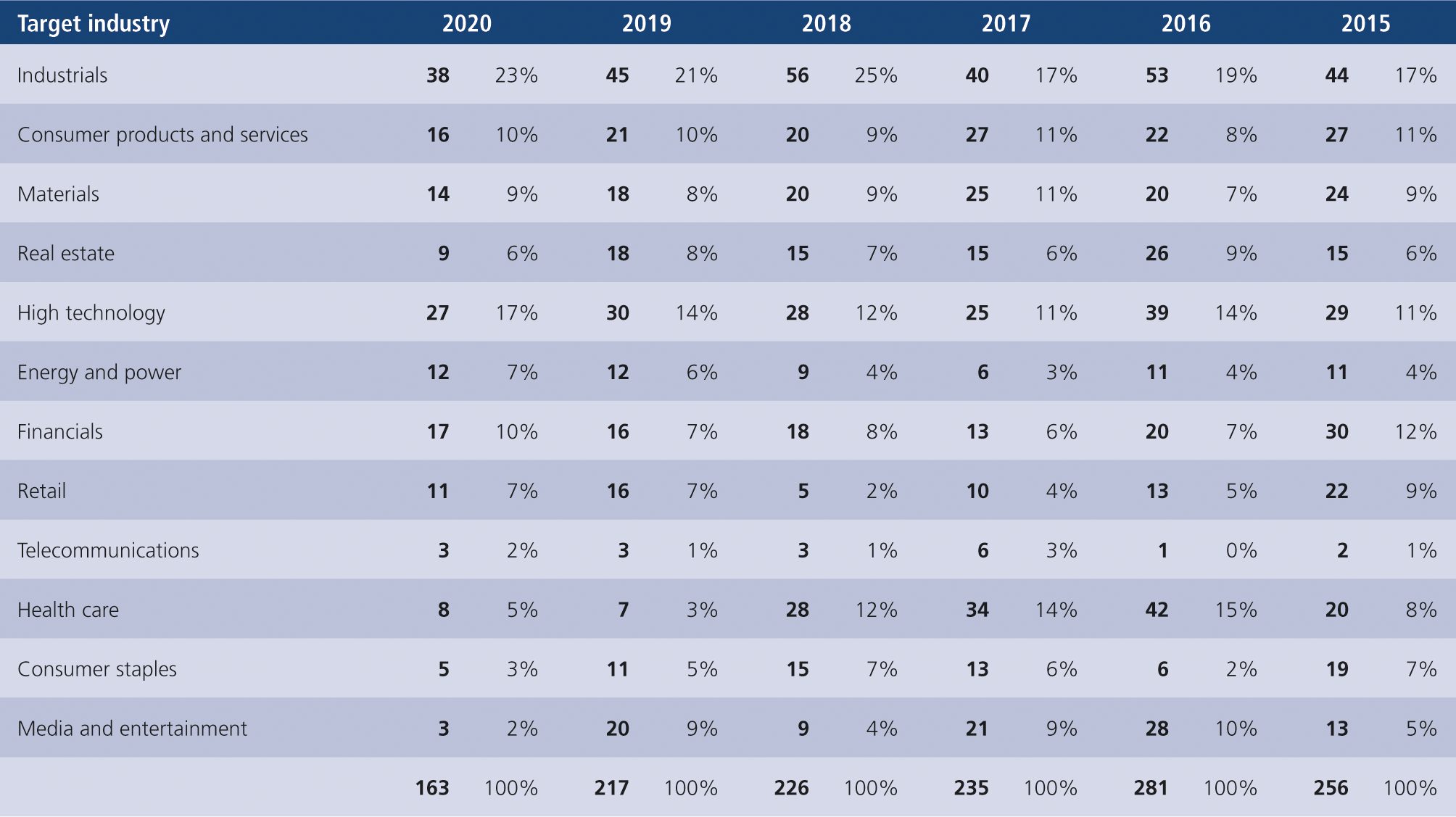

The analysis of M&A activity by industry shows that the decline in transaction numbers affects most sectors, albeit with varying intensity. As illustrated in Figure 1, 10 out of 12 sectors show a declining or stagnating trend, with only health care and finance experiencing slight increases.

Source: Refinitiv; BCG analysis

The ranking of the top sectors is as follows:

• Industrials (38 deals: -7)

• High technology (27 deals: -3)

• Financials (17 deals: +1)

In the sector ranking, the industrial sector leads with 38 registered deals. Compared to 2019, the number of announced deals fell by seven, which corresponds to a relative decline of 16%. This rather solid result is based primarily on the areas of construction, mechanical and plant engineering, and transport and infrastructure. Examples include the takeover of DYWIDAG by Bodner Bau, the acquisition of a turnout plant in France by Voestalpine, and the takeover of the air and sea business of Ipsen Logistics by Gebrüder Weiss. In second place in the industry ranking is high technology. Here, too, activity was relatively stable compared to the overall market, accounting for 27 deals (-10%). Relevant transactions include acquisitions of software manufacturers and IT service providers, e.g., SAP’s recently announced purchase of the customer relationship IT company Emarsys and TTTech’s acquisition of the Turkish software company Red Pine. Financials was the only one of the top three sectors to record a slight increase in activity. The number of relevant transactions grew from 16 to 17 deals (+6%). Among the financial deals—mainly concentrated in banking and insurance—was one of the largest transactions of the past year (EUR 1 billion): the takeover of AXA’s subsidiaries in Poland, the Czech Republic, and Slovakia by Uniqa.

The development in the other industries was predominantly negative, although the extent of the decline varied widely. By far the largest decline in both absolute and relative terms was registered in media and entertainment. Compared to the previous year, the number of deals collapsed from 20 to just 3, representing a minus of 85%. This drop results mainly from a lack of deals in the hotel industry and in the gambling and media sector. A substantial relative decline was also recorded in consumer staples, which fell by 55% (from 11 to 5 deals). The real estate sector, too, experienced a sharp drop, with M&A activity halving (from 18 to 9 deals). Retail (from 16 to 11 deals), consumer products and services (from 21 to 16 deals), and materials (from 18 to 14 deals) declined more or less in line with the market trend. Energy and power as well as telecommunications, on the other hand, remained stable at 12 and 3 deals, respectively, while health care even experienced a slight increase in deal numbers (from 7 to 8 deals).

2.3 M&A activity by the origin of players

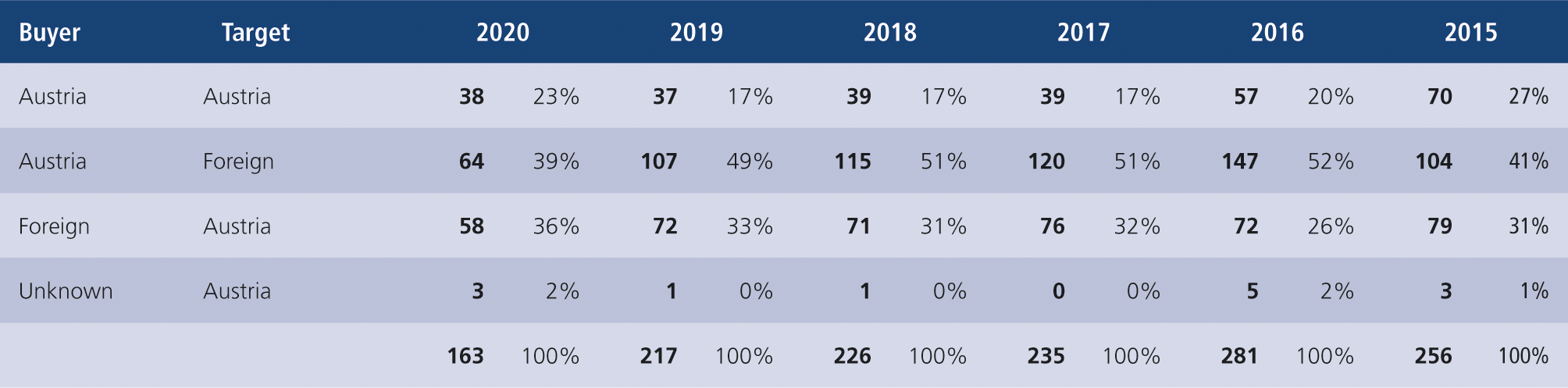

The cross-border statistics (see Figure 2) show considerable differences in the development of domestic and cross-border deals. Domestic deals, contrary to the general market trend, even saw a minor increase (+3%). This means that almost one in four transactions involved an Austrian player on both the buyer and the target side. The number of cross-border deals, in contrast, fell by a third. Austrian companies in particular were less active in acquiring foreign targets. In concrete terms, the number of foreign acquisitions by Austrian companies fell from 107 to 64 deals, a slump of 40%. Looking at the target countries, Austrian players mainly headed to Germany (16 deals), Switzerland (6 deals), and the United States (6 deals). The number of foreign acquisitions in Austria fell from 72 to 58 deals, representing a decline of 19%. German companies were by far the most frequent buyers in Austria (24 deals); transactions initiated by French (5 deals), Swiss (4 deals), and US (4 deals) buyers followed at a large distance.

Source: Refinitiv; BCG analysis

2.4 Global perspective

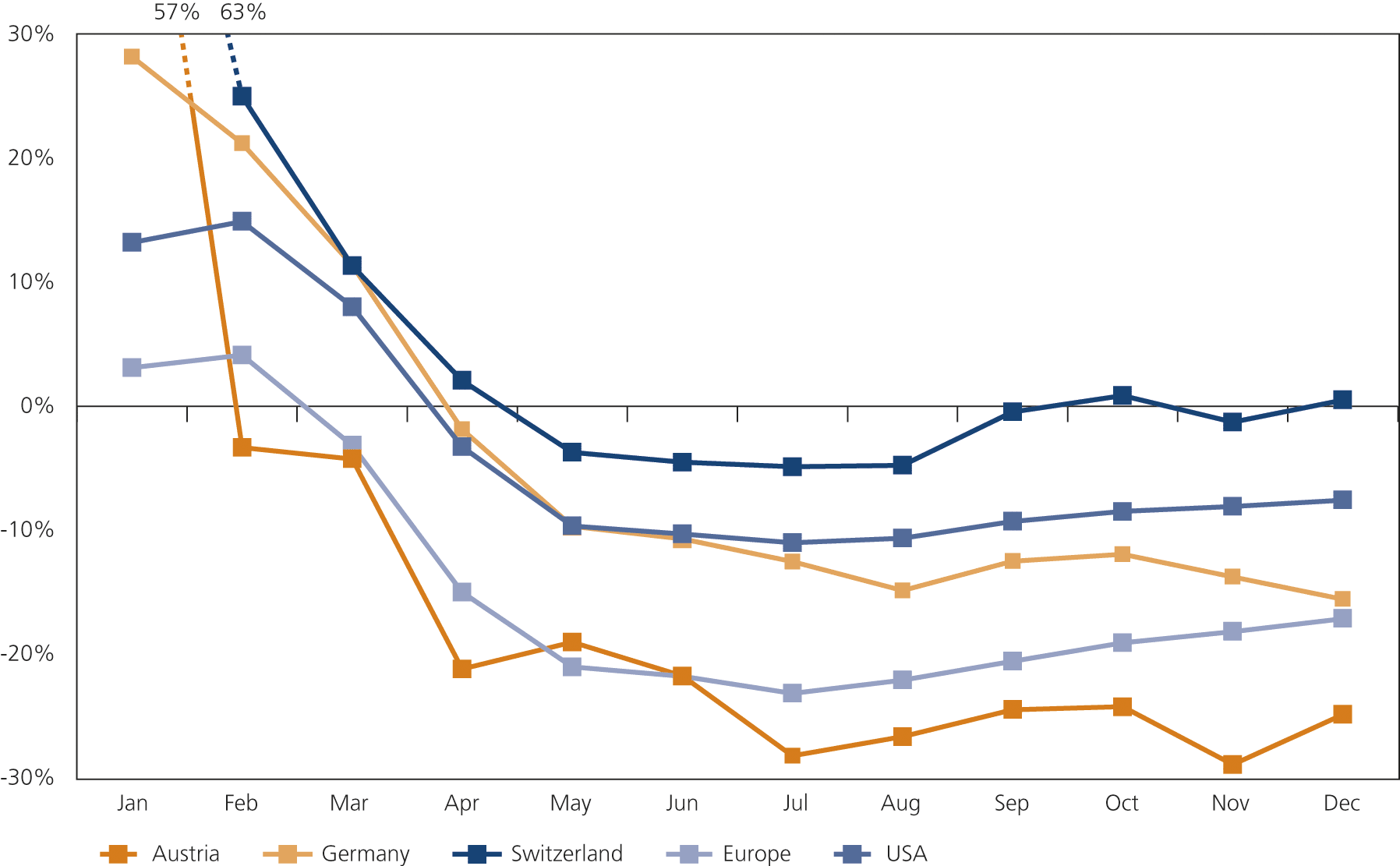

A look across borders shows that the Covid-19 pandemic hit the Austrian M&A market comparatively hard. In fact, the other DACH countries[9. DACH = Germany, Austria, and Switzerland.], Europe, and the United States experienced less pronounced declines than Austria. As can be seen in Figure 3, the initial impact at the outbreak of the crisis and the further development in the abovementioned reference regions were quite different. The Swiss M&A market started the year strongly. The subsequent coronavirus-induced slump in deal activity was largely compensated by a strong second half of the year. In total, transaction numbers even reached the levels of 2019. The German M&A market also got off to a strong start in 2020. However, the initial slump in the spring was followed not by a fast stabilization but by a further downward trend extending into the summer. After a slight recovery in the fall, the market clouded over again, registering a year-on-year decline of 16%. In the United States, M&A activity fell by only 8% year-on-year, thanks to a relatively stable recovery since the summer. Comparing the developments in the reference regions with those in Austria, it becomes apparent that the significant decline in Austrian deal activity (-25%) is associated with a very strong initial impact in the spring. There were some signs of recovery in the second half of the year, as the monthly losses declined slightly. However, unlike in the reference regions, Austria’s monthly transaction numbers up to and including November were still significantly lower than in 2019. As a consequence, deal activity had only recovered marginally by the end of the year. A sectoral analysis reveals various factors explaining the below-average M&A activity in Austria: First, the most deal-intensive sectors of the Austrian M&A market (e.g., industrials, high technology) developed significantly worse than in the reference regions. Second, media and entertainment, a sector that previously accounted for 9% of the total M&A activity in Austria, saw a particularly sharp decline (-85%; by comparison: Germany: -34%, USA: -17%). As explained above, this was mostly due to the low transaction numbers in the previously very active hotel and gaming sectors. A third factor can be found in the differing importance of specific sectors in the reference regions. For example, health care, which appeared very stable in many countries during the Covid-19 crisis, accounted for only 5% of Austria’s M&A market. In contrast, in Switzerland (11%) and the United States (10%), the health care sector’s share is substantially larger.

The data points correspond to the percentage change in cumulative deal numbers in 2020 compared to 2019 on a monthly basis;

Source: Refinitiv; BCG analysis

3. Outlook

The Austrian M&A market shows at best initial signs of a slight recovery by the end of 2020. These can be found in the declining quarterly losses in the second half of the year. Moreover, the fact that, for the first time since the beginning of the pandemic, an increase in deals was registered[10. Compared to the same month of the previous year.] in December (+15%) may be seen as a potential sign of recovery. For the start of 2021, we assume that the deal numbers will not keep up with those of the strong start to 2020. However, in the medium term, two major factors support a sustainable recovery of the Austrian M&A market: First, the Covid-19 vaccination efforts give rise to hopes of a gradual return to “normality,” inducing positive economic effects. Although WIFO significantly reduced its forecast after the third lockdown became known, it still expects the Austrian economy to grow by 2.5% in 2021. Second, a considerable increase in distressed M&A can be expected. The importance of crisis-induced transaction activity was strongly recognizable most recently after the financial and economic crisis of 2008/2009. At that time, restructurings in the financial sector in particular were (partly) responsible for a longer-term upswing in the Austrian M&A market. In the case of the Covid-19 crisis, it seems likely that, especially after the termination of the extensive government support measures, there could be a surge in the distressed M&A sector, boosting overall market activity in 2021.